Demystifying the Background Check Process

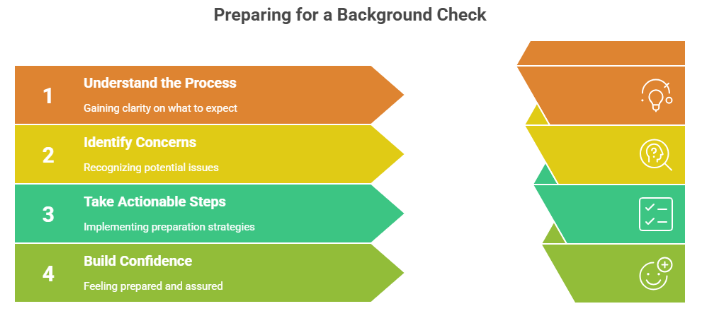

Let’s be honest, facing a background check can feel like walking into the unknown, and it’s totally normal to feel a knot of anxiety about what they might dig up. Maybe you’re gunning for a new job, filling out a housing application, or even stepping up to volunteer, and the whole process just feels… big. I get it. I’ve spent a lot of time over my career deep-diving into and working with background checks, so I’ve seen firsthand the worries people have. That’s exactly why I pulled this guide together. My goal is to peel back the layers on the whole background check process and give you some solid, actionable steps you can actually take right now to feel ready and confident about your own background check preparation. Think of this as your personal roadmap, built on my own professional insights, to help you prepare for your background check without the overwhelm.

Understanding the Basics: What Exactly Is a Background Check?

So, what’s the deal with a background check anyway? Basically, it’s a look into your public and sometimes private history to double-check information and get a sense of your past. Companies, often teaming up with folks called Consumer Reporting Agencies (CRAs) (you might have heard of names like Checkr), use these checks to learn more about people for all sorts of reasons. Think getting hired for a job, applying for a place to live, or even getting insurance. From what I’ve seen, while the specifics can definitely change depending on why they’re doing the check, the main idea is to help organizations make smart choices and avoid potential headaches by confirming details that go beyond just what’s on your application. It’s about getting a fuller picture.

People run background checks for tons of reasons. If you’re applying for a job, it’s pretty standard during the hiring process. Employers use them to make sure you’re qualified, keep the workplace safe, and build trust with their customers and the public. Landlords use them to size up potential tenants, and volunteer groups might run them to make sure vulnerable people are safe. At the end of the day, understanding what is a background check and figuring out why background checks are performed is your absolute first step to getting ready effectively.

What Information Do They Typically Look For?

When an organization runs a background check, they’re essentially putting together pieces of a puzzle to get a clearer picture of your past. While the exact focus can shift depending on the job or situation, there are some key areas they almost always peek into. Getting a handle on these different types of background checks is super important for getting yourself ready.

Criminal History

This is probably one of the most common things they check. A criminal background check means they’re looking through national, state, and local databases for records of serious stuff like felonies, less serious things like misdemeanors, and sometimes even ongoing court cases or arrests that ended up in convictions. The main point here is to spot any potential red flags related to breaking the law.

Employment Verification

Employers almost always do an employment verification to make sure the work history you listed on your application is accurate. This usually involves reaching out to your old bosses to confirm when you worked there, what your job title was, and sometimes even what you were responsible for or why you left. In my experience, one common little hiccup I’ve seen is small errors in start or end dates, or maybe a tiny stretch on a job title. Being totally honest and accurate on your application from the get-go can save you from these small worries later.

Education Verification

Did you say you have certain degrees or diplomas? Education verification is how they check that out. They’ll confirm the degrees, diplomas, or certifications you say you have and the schools you went to. From my point of view, this is a pretty straightforward check just to make sure candidates have the basic knowledge or skills needed for the role.

Credit History

If the job involves handling money or being in charge of finances, they might take a look at your credit history through a credit report check. This isn’t really about your exact credit score, but more about how you’ve managed debt and paid bills in the past. Employers look at things like bankruptcies, judgments against you, or accounts sent to collections to get a sense of your financial habits and spot any potential risks. This makes a lot of sense for jobs where you’d be dealing with company funds.

Driving Records

If the position requires you to drive a company car or needs a commercial driver’s license, they’ll definitely review your driving records. This is where they look for traffic tickets, accidents, and check the status of your license.

Professional Licenses & Certifications

Certain jobs require specific licenses or certifications to legally do the work. Background checks in these fields will confirm that these credentials are valid and in good standing with whoever issued them.

Social Media & Online Presence

More and more, employers are doing a quick look at what’s publicly available about you online, including your social media & online presence. While the rules and how deep they can dig vary, it’s definitely becoming more common. My take on this is that while a full-on deep dive isn’t super frequent, anything easily visible that shows poor judgment or a lack of professionalism could absolutely sway a hiring decision. So, be mindful of what’s out there!

Taking Control: Proactive Preparation Steps

Instead of just sitting around and stressing about a background check happening to you, the smartest thing you can do is take charge and get started on your own prepare for background check process before anyone else does. By doing these things, you can spot and fix any potential hiccups ahead of time, which will help you navigate the whole hiring process feeling much more confident.

Obtain Copies of Your Reports

From what I know, the absolute most important first move is to get your hands on your my background report details straight from the source. Good news! You can get free copies of your annual credit reports from the three big guys – Equifax, Experian, and TransUnion – by going to AnnualCreditReport.com. For your job history, you can even ask the IRS for a tax return transcript; it shows past employers and how much you earned. It’s free, but just a heads-up, it can take up to ten days to arrive. Depending on your history, you might also want to look into getting a copy of your driving record from your state’s DMV or check out services that pull public records (just remember that free searches might not show everything). Looking through these reports is your very first chance to see what a potential employer might see.

Carefully Review Everything

Once you’ve got those reports in your hands, go through everything really carefully, line by line. Be on the lookout for any mistakes, errors, or stuff that just seems old or not quite right. Double-check your personal info like your name and address, and super importantly, verify the dates of your jobs, the degrees you earned, and any criminal records listed. A common mistake I’ve seen people make when they’re reviewing is just rushing through it. Trust me, the details matter, and even a small error could slow things down or cause misunderstandings.

Understand What Shows Up (and What Doesn’t)

It’s helpful to have a good grasp of what shows up and what doesn’t typically appear on a background check. For example, thanks to the Fair Credit Reporting Act (FCRA), most negative stuff on your credit report, like late payments or accounts sent to collections, can only be reported for seven years. But, some things, especially felonies, might stick around for longer or even indefinitely depending on the job, how much it pays, and the laws in that state. My expert take is that while smaller, older issues might